We knew it was going to happen eventually.

Sears Holdings Company recently announced the latest wave of closures for its two flagship department stores—Sears and Kmart—and they did not spare metro Indy from the chopping block. This time around, the Sears is closing at Castleton Square Mall, the largest and, in most regards, the best-known mall in the region. Once Sears is gone, the chain will only have one location left in the entire metro of two million: down on the south side, at Greenwood Park Mall.

We could assert that Sears’ departure is a huge blow to Castleton, but the company has been ringing the death knell for about a decade. No increase in vacancy is ever a good sign, but Sears has been such a weak link for such a long time, I blogged about its underperformance at Castleton almost a decade ago.

Back then, I noticed that most of Castleton appeared to be thriving—except for the wing of the mall with a hallway that terminated at Sears. While most of the mall featured nationally recognized middle-market brands like Lane Bryant or New York and Company, the Sears hallway mostly contained local obscurities: KT Sports, Unplugged, Nirvana. One vacant space didn’t even get used for a retailer any more; it just hosted a bunch of candy machines.

The gap between Sears and the rest of the mall was so noticeable that I speculated that rents were lower on the Sears hallway, since it didn’t get as much foot traffic. The hallway also had the highest vacancy levels in the mall.

But this condition wasn’t unique to Castleton. A few months later, I noticed more or less the same situation at the Mall at Cortana in Baton Rouge. This mall, however, was in much worse shape than Castleton, with up to a third of its in-line tenant spaces empty. The Sears wing was the worst; customers essentially had to walk the equivalent of a city block among vacant storefronts to get to the Sears.

I haven’t been to Cortana since basically 2010, but most evidence I can gather suggests it’s even worse. About 65% vacant. It has only one real anchor tenant left, a Dillards Clearance Center, as well as a junior college in a former department store space. Sears left years ago, and, incidentally, the website still implies that J.C. Penney is around, even though it bailed last summer. Cortana is, for all intents and purposes, a dead mall.

The same can’t be said for Castleton Square, which remains one of the state’s largest retail hubs—perhaps the largest. Unfortunately, there doesn’t seem to be much chance of a replacement for Sears. After all the department stores consolidated in the early 2000s, what’s even left? The only likely options that come to mind are a Lord and Taylor, the upscale chain that’s floundering as well, so unlikely to take a risk at a middle-market mall like Castleton. And then there are Dillard and Belk, the two southern chains, and while they don’t get a lot of negative press, which suggests they’re surviving, they don’t show much interest in expanding. Dillard has a small presence outside the south, particularly in Ohio; Belk is exclusively southern.

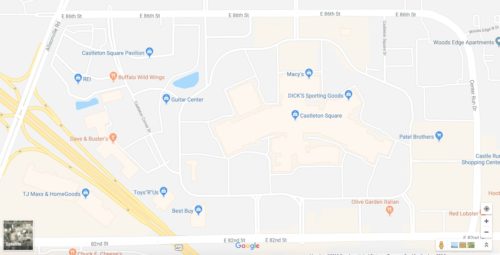

That leaves Castleton in a real predicament. The mall itself is huge, at over 1.2 million square feet, but it’s also part of a retail campus that extends in all directions, offering a variety of big-box and out parcel tenants around the expansive perimeter. Here’s a Google aerial.

The parking lots are so vast that it’s hard to distinguish them from the rooftops, so the conventional map is a good solution.

If you really take a close look, you can discern a difference between the two, in the northeast corner of the campus, where the perimeter road curves gently. The aerial shows rooflines for an outlying shopping center, but in the map, those buildings are not there. What happened?

Here’s a Google Street View of that northeast corner back in the summer of 2014. A few months later, Target Corp. announced the closing of 11 underperforming stores, and the Castleton location was among them. By 2017, this is what that corner looks like. Pretty bleak. And while no portion of the greater Castleton campus is quite as bad as this, one can easily drive around the perimeter ring road of the mall and see that the supply of retail space vastly outstrips the demand—a condition throughout the United States, exacerbated in recent years after the implosion of retail. Even though Castleton remains one of the highest profile commercial hubs in the state, the entire complex—central mall and periphery—now suffers probably a half million square feet of unnecessary leasable area. The Target was at a terrible location within the greater mall area, since it was far removed from the major arterials, and most people would never know it was there from just driving nearby. However, in this day and age, with smart phone possession the norm and Google Maps in every pocket or purse, can analysts really fault a lack of visibility? The Target closed because the thinning retail presence all around it weakened the viability of an already mediocre configuration in an otherwise great area. And now, this continued weakening viability, caused less by Castleton’s location (still quite advantageous) and more from retailers persistently going out of businesses, has dragged the already failing Sears into the abyss.

Shortly after the closure, Simon Property Group announced a “transformational redevelopment†of the two-story Sears site at Castleton, to combine retail, fitness, dining and entertainment. It’ll probably parallel the repurposing of the Greenwood Park Mall from a decade ago, when Simon morphed the vacant L.S. Ayres wing into an outdoor-oriented lifestyle center with fountains, plazas, a few somewhat upscale shops and a Barnes and Noble as an anchor. It worked quite well for the Greenwood Park Mall, which, now that Castleton has suffered this setback, may be the single most successful major mall in the state.

I think the folks at Simon need to be a bit more ambitious with the vacating Sears at Castleton. In 2018, lifestyle centers aren’t much better off than enclosed malls, and if the mall can’t engage the oversized space with a mixture of different uses, it’s only likely to face similar problems. My speculation is that Simon should see the vast, contiguous stretch of vacancy between the old Target and the Sears as an opportunity. If the company doesn’t own the old Target outparcel, it should buy it (probably doesn’t cost much), and integrate it with the Sears redevelopment. Hotel space should be fairly lucrative, since it’s an industry that’s already doing well, and the location close to two interstates would already make it attractive. Apartments and office space may complete the mix, culminating in a centralized, pedestrian-oriented plaza that places a premium on good design. It has to attract people by offering a unique experience, and in this day and age, a conventional mall just isn’t going to cut it.

Any other sort of redevelopment at the Castleton Sears is likely just kicking the can down the road. I’m not yet suggesting Castleton will turn into the next Cortana. But based on the national state of retail (and malls, as a result), the odds are greater than ever that, without that radical transformation, the best of malls will face their demise, sooner than we ever care to admit.

I think the fractured nature of property ownership is going to make a full-scale re-development of Castleton Mall difficult. Sears actually owns the property and the surrounding parking lot (and Target still owns the closed Target store). Simon owns the parking lot around buca di beppo but doesn’t own the property where the restaurant sits on. A lot of those free-standing restaurants listed on the mall’s site aren’t actually owned by Simon.

And then all of the surrounding areas are all owned by a variety of landlords, and some clearly are fine with letting the property go to pot rather than try anything.

And I’m not so certain Castleton is doing well. There’s been a drastic increase of those damn kiosk sales people in Castleton and they’re increasingly very aggressive. You don’t see that type of stuff at the Fashion Mall.

Normally I’d agree with you, Matt about the challenges facing Mall redevelopment in terms of fragmented ownership. But Sears is no doubt eager to sell off more of its real estate and Simon is likely to buy. Also, I incorrectly cited one of my sources earlier (since corrected), but the hyperlinked phrase “the closing of 11 underperforming stores” above takes you to Indianapolis Business Journal, and the article (if you have access) claims that Target normally owns, but the Castleton space was leased.

I can’t help but wonder if some of those other slumlords are letting their properties go to pot in the speculative hopes of something like a “transformative redevelopment” where they can still sell for top dollar to a deep-pocketed buyer like Simon.

You could be right about the kiosks. Then again, I’d say aggressive sales people at kiosks are still a better sign than empty kiosks. Back when I frequented Greenwood Park Mall in the early 2010s, it had a ton of those pushy people, and at least back then, its financial performance seemed pretty stellar.

Is Castleton one of Simon’s top performing malls? No. But it has one of the best performing Macy’s stores in the midwest, and the mall itself certainly isn’t having serious trouble. Vacancy rates are only apparent near the Sears and JCPenney wings, which makes sense. Spaces around Macy’s, Von Maur, and the lifestyle center are full with nation tenants. Sales per square foot were above the national average last year.

If Dillard’s were to enter the area, they would likely do it at a more premier mall, like Keystone or even a center like Clay Terrace. Lord and Taylor is a no, and Belk, as the author said, is pure southern. I could see something like a Zara or a Primark anchoring a lifestyle center to compete with H&M and Forever 21.

By and large I agree with you, Davis. I’d imagine Castleton the mall is performing above-average among malls across the country. And it sounds like the numbers support this.

The problem is the overall condition of malls and their trajectory of decline. Many years ago I noted how the “Sears wings” of malls tend to underperform in comparison to the rest of the mall. Now you’re saying that, at Castleton, it was both the Sears and JCPenney wings. Also, the vast stretch of big-box and strip mall retail that surrounds Castleton is a disaster, and has been pretty awful for about 15 years. It’s bad enough that the City is evaluating ways to revitalize the area.

I just don’t see another tenant coming in to Castleton, because, even though it’s still an above-average mall, it’s hardly at the tier of the top-performing ones. Let’s face it: are there any department stores that are generally expanding? Dillard’s is not in the Indy market, and while it hasn’t seemed to suffer the same way Macys/Sears/JCP have, some of that is due to a careful expansion strategy…and Dillard is often one of the first anchor tenants to bail from a mall with early indicators of decline. You may be on to something with Zara/Primark, but, again, are they going to take a risk on a mega-center and its bleak surroundings, when the area couldn’t support a Target? I think Castleton is going to need radical changes to right the ship–which is the same case with over half the malls in the country.

Eric, I wonder if they’re thinking about something like the new King of Prussia Town Center? It’s a similarly prime location in the favored quarter, at the junction of major highways and arterials. (The KoP development is NOT on Simon property but obviously takes advantage of the mall’s proximity. That site is a long-vacant parcel that was once a motel and golf course…itself another typology under redevelopment pressure.)

To get the necessary scale, I agree they’d have to assemble some more land…and maybe Target would want to come back to that kind of development? There were not too many years between Target closing their 53rd and Keystone store and reopening a new store in the Glendale Town Center mall redevelopment just blocks up the road. There is not another Target on the northeast side between Keystone and Washington Square, until you get way out to the impossible-to-get-to location at 116th and 69.

Are you talking about how they connected the two separate buildings that comprised KoP? I thought that was a Simon venture. Maybe you’re referring to something else.

I think Simon’s redevelopment would have to bat it out of the park to bring people back to Simon in droves enough to lure Target again…and while I think the folks at SPG are capable of big thinking, it remains to be seen if they’ll actually implement something spectacular in their hometown.

There is actually a new lifestyle/town center development just across I76 west of KoP, anchored by Wegmans and Nordstrom Rack, with apartment and office space (and a pre-existing Walmart). Not a Simon development, but similar to the open air portion of Greenwood Park or Clay Terrace.

it doesn’t help castleton that crime and misbehaving teens/kids has been scaring off people and increasing the negative perception of the area, i mean a kid was murdered near the denny’s not too long ago and they didn’t catch the shooter. I worry that simon malls doesn’t have the right people in place to correct their trajectory. they’ve been trying to hire someone for the Master Planning and Redevelopment director position for quite awhile but they want someone with minimum 20 yrs experience. But if you’re trying to attract people in the 18-39 demographic why would you try to get someone in their late 40’s 50’s to do that? I don’t think they’re ambitious or ballsy enough to fix most of their problems. I don’t think they want to make big moves which is why they’ve been stuck on this path they’re on, I mean look how long it took for them to get an entrance on Georgia street for the circle center… That should’ve happened when they remodeled that street and it should’ve been a more significant entrance, not the paltry solution they came up with.

Fixed the Castleton Mall issue.

https://drive.google.com/open?id=1_ekp2AgdR8VCYLr7o_iAx_yCdBcYHUbq&usp=sharing

Yes! Then just sell properly zoned parcels…… No mega project – no “vision” for the future. Just bottom up spontaneous order

*chaos.

Note: chaos is a good thing in this scenario. It is always better to have dozens or hundreds of independent operators than one giant operator. I always get very frustrated when the city bends over backward for Lilly, Rolls, or lately, Anthem with their stupid parking lot. How about instead you create an environment for hundreds of small (<20 employees) companies to try their hand?

wait wait wait, are they getting that parking lot at anthem???

The retail landscape is changing. I don’t care what the S&P or NASDAQ is, the economy has never really recovered from the decline of union manufacturing wages from what I’ve seen. Sure, we’ve had a tech boom, usually with great wages, but those jobs take a certain level of IQ and aptitude to obtain. A lot of average folks with lower IQ can’t obtain those jobs. All the wages are now lower, so there is less shopping for sure.

Combined with other things like student loan debt, interest rates going up (even if slowly), vehicles costing more and more…people are tapped out. Then factor in Amazon and other on-line retailers, brick and mortar as it has historically been is dead. Most of the dead malls found on-line are in smaller cities that were the worst hit with the decline in manufacturing jobs. Now we are seeing it trickle into the big cities.

What an autocentric hell hole that area is – or appears to be from Google Maps. I don’t know the local area or the culture of suburban Indy, but my sense from looking at the surrounding area is the only thing that *might* work there given the over abundance of retail and its decline is to rip up everything, take it back to dirt and plant a bunch of suburban housing with cul de sacs. It would at least be congruous with what is around it. And if that topology has demand in the area it might work – for a while anyway. But the thought of turning it into a new urbanist kind of place with a street grid given the autocentric nature around it, is an incongruous pipe dream doomed to failure. As Kevin Klinkenberg says this kind of sprawl is just not worth anyone’s attention to try and repair because it is what it is and won’t ever be anything else at least until there is major catastrophic or dislocative change.

Alex, Indy has one of the highest 2 or 3 “commute alone in car” shares of any metro in its size class (~2million). What you see there is a normal consequence of our car dependence at that level.

That is what a car-based suburban CBD looks like.

The nearest cul de sac is quite a distance away, as there are rings of offices, apartments, and highways surrounding the mall. It is not unlike King Of Prussia, PA.

Think pre-Metro Silver Spring MD.

LOL, guess what, even with the Metro it still sucks. Not quite this bad, but close.

I remember driving there from a friend’s house to catch the Red Line in the late 70s. It was a sea of parking lots until more-dense development repurposed some of the strip malls and asphalt.

Hi Alex—Chris is right: Castleton is completely in keeping with mall development from the 1970s and is basically on par with King of Prussia or Tyson’s Corner, but a whole lot smaller (obviously). Still pretty big though, and definitely oversized for 2018 retail demand. I’d bet that, with the outparcels, the greater stretch of Castleton is about 30% vacant…yet it’s still considered an above-average performing mall.

Bearing that in mind, there’s more potential than just cul-de-sacs; lots of office space nearby, and the road on the south (86th Street) is probably the single biggest suburban commercial/retail corridor in the whole metro. About 1.5 miles to the west is Keystone at the Crossing, which is Indy’s primary Edge City.

it is. and no sidewalks. i used to have to drop my car off at firestone for an oil change and then walk back to work and it’s nothing but street, parking lot or grass…. and it’s a longer walk than it feels in teh car.

I’m 68 years old, and part of the mall generation. I watched the waxing and waning of Castleton, and the whole problem is that traffic in the area has made Castleton a “no-go” for many people. This is especially true for seniors who, like me, still prefer to do the majority of their shopping in stores rather than on the internet. Although I do both. The idea of fighting traffic to get into and out of the mall, just isn’t worth it to me.

Thanks for writing, Richard, though I admit I’m a bit confused by this observation. If the mall has “waned” as you say, wouldn’t that have actually made the traffic less of a problem? It would seem at this point that Sears closed (and the Target before it), due to a lack of traffic, both vehicular and pedestrian.

I don’t want to speculate on Richard’s thoughts, but I think a possibility is that all the other retail sprawl around there (strip malls, Costco, furniture stores, etc) are causing heavy traffic around the area of the mall. Personally, I don’t think that holds much water and tend to think online shopping is the main driver.

The main mall entrances are on 82nd St. between Allisonville and I-69/Shadeland, or from 86th and Allisonville.

I agree with Richard that the traffic to get to the mall entrances is very heavy regardless of the dropoff in mall shopping…partly from the district’s retail sprawl, partly from the dense residential along Allisonville, partly from the big office park north of the mall, partly from crosstown traffic heading west to the Keystone Crossing area, and partly from other crosstown traffic avoiding congestion on I-465 at I-69 and at 96th and Keystone.

I can’t imagine life without Sears. Have used Sears paint for 60 yrs in and out always Sears appliances yard things. Can’t stand the thought of no Sesrs. Can’t believe this is happening. My Dad would not survive this if he was here. Glad I got my washer and dryer in time. Good bye to a wonderful era.